The European foundry industry in 2021: the rebound does not bring production back to pre-Covid levels

According to data from the annual report published by the CAEF, the production of castings in Europe grew by +16.8% in 2021 compared to the previous year.

The European production of ferrous and non-ferrous metal castings in 2021 reached 14,509,300 tons, with an overall growth of +16.8%. Despite this important rebound, the production gap compared to the pre-Covid year is still around -7%. The extent of the gap is substantially similar for both ferrous and non-ferrous.

The total increase was mainly driven by the ferrous metals sector (cast iron and steel) which, with an increase of +17.6%, brought its output to 10,707,400 tons. The contribution of non-ferrous castings, on the other hand, was +14.8% with a volume of 3,801,900 tons.

Some macroeconomic elements of the European production of metal castings

2021 was still a year dominated by the Covid-19 pandemic. Economic activity has suffered mainly due to the lockdowns which have caused alarming disruptions in global supply chains. 2021 was also a complicated year for the European foundry industry, full of more or less serious challenges depending on the client sectors of destination of the castings. In the second half of the year, the positive results of the vaccination campaign led to an easing of tensions, even if the spread of new variants continued to condition the recovery process in Europe.

Contrary to the European approach and despite the low number of infections, the Chinese government has followed the so-called zero-Covid policy. Prolonged Chinese lockdowns and subsequent closures of international hubs have led to unprecedented disruption in global trade and value chains. The increase in energy prices and the limitations of transport capacities subsequently triggered an unprecedented inflationary process, as well as causing blockages in shipments with progressive accumulations of intermediate goods and raw materials in the ports of embarkation.

Despite the critical issues listed, the 2021 macroeconomic data for China and the USA showed good stability, with GDP growth of +8.1% and +5.7% respectively. Conversely, supply chain problems have hit Europe and other industrialized countries hardest. Germany, which boasts a strong vocation for the automotive industry, has been strongly affected by supply disruptions. In this case, its economic growth reached only +2.6%. The average GDP growth of the CAEF countries was +5.5% after the drop of 6.4% in 2020. The government interventions introduced by the individual countries supported companies by containing the average unemployment rate to 7.4% with an improvement of 0.3 percentage points compared to 2020. Meanwhile, consumer prices grew by +3.3% in 2021 (+1% in 2020).

The situation in the main industries that purchase foundries

Vehicle construction

The international automotive market has been hit hard by supply chain disruptions and especially by semiconductor shortages.

The production capacity of the semiconductor industry is based on long-term planning. For this reason, the offer has had a certain rigidity in responding to the greater demands on the demand side, the level of which has grown significantly both due to the push towards digitization imposed by Covid all over the world, and due to the phenomenon of electrification of engines in the automotive sector. Especially in the second half of 2021, the semiconductor shortage has heavily impacted the production of the auto industry.

In 2021, car sales in the EU decreased by an annual average of 2%, reaching around 9.7 million units, with a progressive deterioration in the final part of the year. The gap accumulated by the EU market compared to the pre-crisis period has grown by 3.3 million registrations.

Compared to the most important EU markets, only Germany recorded a decrease (-10%) in 2021. Conversely, Italy recorded the largest increase (+6%), followed by Spain (+1%) and from France (+1%). Also in the United Kingdom, car sales increased slightly (+1%). The Turkish market recorded a significant decline of 8%.

In the United States, the light vehicle market (passenger cars and light trucks) closed 2021 with almost 14.9 million vehicles sold (+3%). Despite regional lockdowns, China has largely managed to recover from the disruptions of 2020, recovering 2019 levels thanks to a +7% increase (21.1 million units), also confirming itself as the largest global market of cars. The Japanese market totaled 3.7 million passenger cars, about 4% less than the previous year, while sales of light vehicles in Russia increased by +4% to 1.7 million units. The most significant increase was recorded by India with +27%, while Brazil reported modest growth of around +1%.

Mechanical Engineering

In 2021, the production of machinery, plant and equipment that is part of the mechanical industry within the EU market exceeded the results of 2020 by 12%, but with a gap still of 2% compared to 2019. The persistent bottlenecks on the supply slowed down the productive momentum of this industry which regained strength in the last quarter of 2021 when growth returned to 8%.

The global production of machinery and equipment amounted to 3 trillion euros in 2021, about 15% more than in the pandemic year 2020. In China alone, the turnover amounts to almost 1.1 trillion euros and the increase of 18% confirms its position as world leader also for the mechanical sector. Among other countries, Japan achieved a significant growth rate of +17%, while the United States had to settle for +10%.

Despite the impact linked to the very serious problem of the interruption of supply chains, in 2021 Germany maintained third place with a turnover of 311 billion euros (+10%), positioning itself behind the United States (347 billion EUR). Together, the 27 countries of the European Union express a turnover of 748 billion euros in the production of mechanics, about a quarter of world turnover.

Construction industry

In 2021, the European construction sector experienced growth of 5.6% after the drop in 2020 (-4.4%) caused by the pandemic and national and sectoral closures aimed at halting the development of infections. The 2021 recovery allowed this sector to return to 2019 levels.

Ten Western European countries achieved a higher total volume of construction investment than in the pre-pandemic period of 2019. Among the BIG-5 countries, only Italy significantly exceeded the pre-crisis level (+13 .0%, after a decline of 4.5% in 2020).

In Germany, construction production in 2021 was close to the 2019 level (+0.1%), while in France it was 5.7% lower, in Spain by 3.2% and in the United Kingdom by 2%. 9%. The Nordic countries also achieved a total volume higher than in 2019 and in particular Denmark showed the highest growth (+17.8%).

Of the four Central and Eastern European countries, only Poland achieved a level above 2019 (+1.5%).

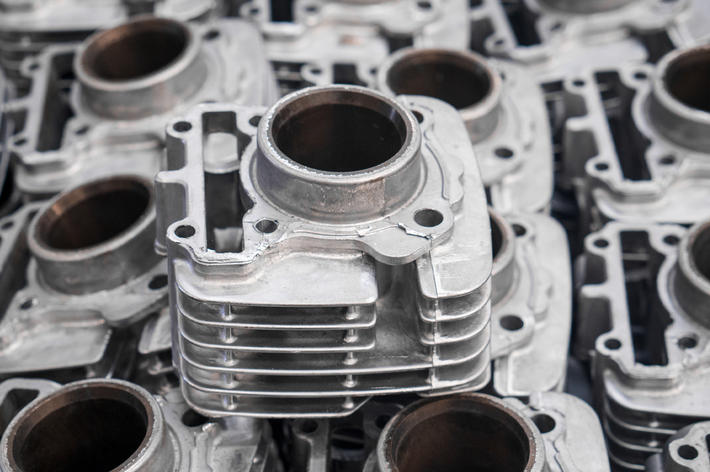

The European foundry: data and statistics on non-ferrous metal castings

Companies and employees

The European landscape of non-ferrous metal foundries, in 2021, lost about 1% of production units and the total number has slipped below 2,300 companies.

On the other hand, employment had an opposite dynamic with a growth of +1.9%, for a total of about 115,200 direct employees.

Italy has an average size of non-ferrous metal foundries of around 22 employees per company, an average production per employee of around 47 tonnes and an average production per company of 1,044 tonnes.

Germany, on the other hand, has an average size of 97 workers per firm, an average production of 26 tons per worker and 2,503 tons per firm.

Production

In 2021, non-ferrous metal foundries (aluminium, copper alloys, zinc, magnesium, etc.) in CAEF member states recorded an increase in production of 14.8%, bringing the total output to 3.8 million tons .

The three main countries producing non-ferrous metal castings, Italy, Germany and Turkey, account for 61.6% of the total volume and Italy and Germany alone hold a share close to 45%. In both Italy and Turkey, in 2021, the production of metal castings grew at a faster rate than the European average (+33.6% and +29.4%).

On the other hand, Germany achieved modest growth of 4.8% which led it to cede the leadership of the non-ferrous sector to Italy; the gap compared to 2019 for Germany extends to 20.1%.

The production of castings in alloys and non-ferrous metals is dominated by light metals: aluminum and magnesium account for 87.3% of the total; the share of copper alloys maintains its weight at 5.7%, zinc alloys at 6.2%, while the remaining 0.8% consists of other non-ferrous alloys.

Source: In Fonderia – ll magazine dell’industria fusoria italiana